Currently Empty: $0.00

Consignments

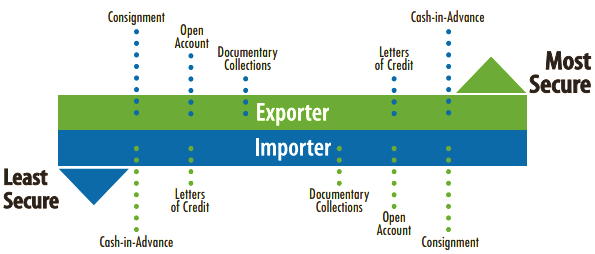

International trade considers consignment as a type of open accounts. The essence of the technique is that the seller sends the good to the foreign distributor who is entitled to find the end customer and sell the product. The seller gets money for goods only after that moment when the end customer is found and the products are sold. Contractual arrangements are basic elements of international consignment transactions. According to this arrangement, the product is received, managed and sold by the distributor. This type of cooperation is quite risky for the seller since the goods are stored abroad and no payment at all is guaranteed. At the same time, such a transaction allows the seller to increase competitiveness due to better availability and make products delivery in a particular country faster. Due to consignment, the seller also can reduce the direct costs products storing as well as managing inventory. Such a way of cooperation is quite successful if the seller chooses a trustworthy logistics provider and reputable foreign distributor. An important part of consignment is appropriate insurance that allows mitigating the risks of non-payment or any damages while shipment.